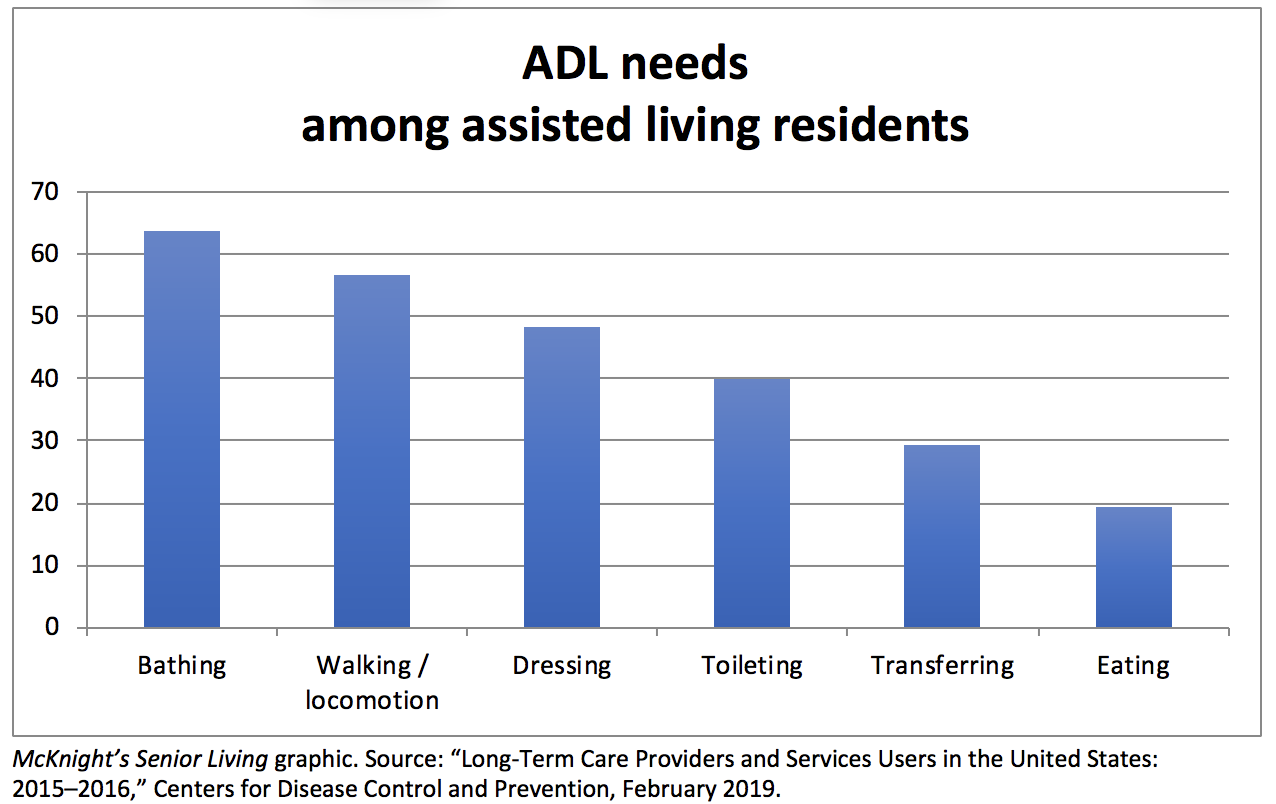

It’s a common refrain in senior living that today’s assisted living communities are closer to yesterday’s skilled nursing facilities.

You are here

No surprise: Data underpins care quality in senior living and home care

For too many years, high quality data about care of seniors has been elusive. Lack of standardization of technology platforms – or lack of care platforms altogether – hobbled the care industries -- senior living, home care, home healthcare. Yet the merger and acquisition of companies in other industries ultimately results in consolidation of data. Platforms matter—they enable data standardization which in turn fuels growth. Consider Jet Blue’s interest in buying Spirit, getting planes and pilots(infrastructure) that match its current business. Consider Optum’s acquisition of Amedisys home health business. Note its 2015 $72.5 million write off of a failed in-house software deployment process. No doubt, Optum’s own data standardization business will help integrate Amedisys if the acquisition is improved.

For too many years, high quality data about care of seniors has been elusive. Lack of standardization of technology platforms – or lack of care platforms altogether – hobbled the care industries -- senior living, home care, home healthcare. Yet the merger and acquisition of companies in other industries ultimately results in consolidation of data. Platforms matter—they enable data standardization which in turn fuels growth. Consider Jet Blue’s interest in buying Spirit, getting planes and pilots(infrastructure) that match its current business. Consider Optum’s acquisition of Amedisys home health business. Note its 2015 $72.5 million write off of a failed in-house software deployment process. No doubt, Optum’s own data standardization business will help integrate Amedisys if the acquisition is improved.

The home and senior care industries have long needed standard apps and underlying data. Some firms have standardized on PointClickCare (‘it’s all about the data’). The rationale for selecting a platform? Manage the wellbeing, security and satisfaction of the residents. Without a standard set of data about residents, including staff scheduling, care plans, and communication with families – it’s hard to know if a community or agency is profitable until it’s too late. The same applies in home care – hence Honor’s acquisition of Home Instead, and no doubt the subsequent standardization on Honor’s technology/data platform.

Data has always mattered for delivering good care, but hurdles were great. A decade ago, it was obvious about what data mattered in home care – but it was too early to standardize. Why? Market fragmentation, for one. Relying on staff as the key differentiator among home and senior care businesses; and finally, a worker shortage that had yet to reach crisis proportions. In senior living a decade ago, Brookdale was about to spend $2.8 billion to acquire Emeritus senior living, following a $23 million damage from a lawsuit – one of several related to poor (and unmonitored) care. Would better data -- about staff ratios and training, resident health issues and care requirements, regular sharing of care status with families and management – have made a difference in the care outcome that signaled the end of Emeritus?

Senior care data mattered in the investment of $29 million in CarePredict. The CEO of one of the acquiring companies noted: “CarePredict’s unique approach to data accumulation and analysis allows us to realize our goal of virtual integration and predictive interventions.” Not a surprise since that company manages more than 100 senior living companies. As with CarePredict, skill at data management may drive more care industry consolidation and acquisitions. Data, of course, is the backbone of AI. Other examples: Caspar.ai offers “30+ actionable insights about the resident’s health and vitals.” And CareDaily offers "comprehensive analytics derived from data collected through ambient sensors and devices placed in the home." Consider The Future of Sensors and Older Adults. Note the conclusion: The data obtained from sensors, used as alerts and sources of predictive analytics, will be assumed by families as they consider senior living and home care choices for their loved ones.

[See the latest report, The Future of AI and Older Adults 2023]