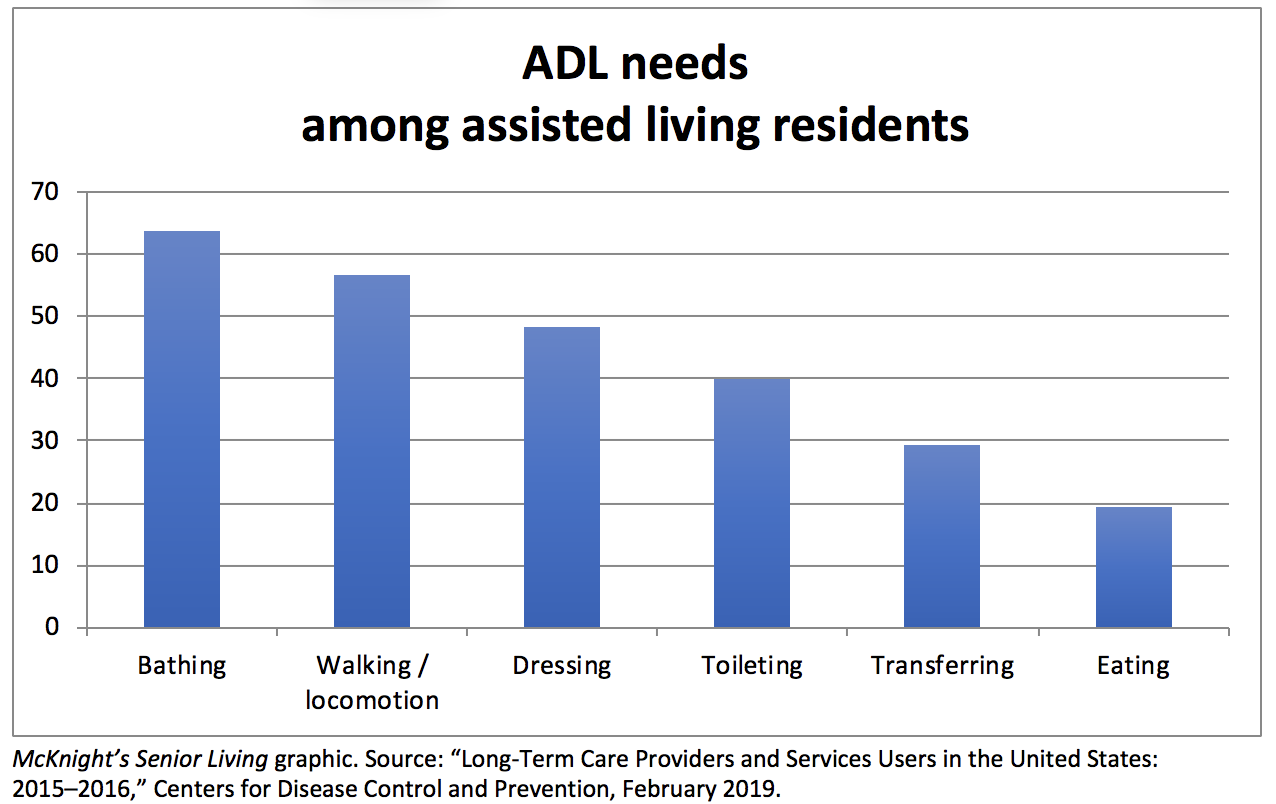

It’s a common refrain in senior living that today’s assisted living communities are closer to yesterday’s skilled nursing facilities.

Seekers of Meaning Podcast Posted Online March 7, 2025

What's Next Longevity Deal Talk Episode 32, January, 2025

What's Next Longevity Venture Summit, June, 2025

Long ago 'aging in place' terminology emerged with a different meaning. Forgotten now, it was briefly in Wikipedia to define the benefit of a

Long ago 'aging in place' terminology emerged with a different meaning. Forgotten now, it was briefly in Wikipedia to define the benefit of a  The care continuum that serves older adults is an ignored reality. The stove-piping of care-related services is a myth. It is perpetuated in

The care continuum that serves older adults is an ignored reality. The stove-piping of care-related services is a myth. It is perpetuated in  For too many years, high quality data about care of seniors has been elusive. Lack of standardization of technology platforms – or lack of care platforms altogether – hobbled the care industries -- senior living, home care, home healthcare. Yet the merger and acquisition of companies in other industries ultimately results in consolidation of data. Platforms matter—they enable data standardization which in turn fuels growth. Consider Jet Blue’s interest in buying Spirit, getting planes and pilots(infrastructure) that match its current business. Consider Optum’s acquisition of Amedisys home health business. Note its 2015

For too many years, high quality data about care of seniors has been elusive. Lack of standardization of technology platforms – or lack of care platforms altogether – hobbled the care industries -- senior living, home care, home healthcare. Yet the merger and acquisition of companies in other industries ultimately results in consolidation of data. Platforms matter—they enable data standardization which in turn fuels growth. Consider Jet Blue’s interest in buying Spirit, getting planes and pilots(infrastructure) that match its current business. Consider Optum’s acquisition of Amedisys home health business. Note its 2015  Has anyone you know fallen and couldn’t get up? If so, would you pick up the phone and call Life Alert, the purveyor of those miserable ads on TV? This is not a fun company – read the

Has anyone you know fallen and couldn’t get up? If so, would you pick up the phone and call Life Alert, the purveyor of those miserable ads on TV? This is not a fun company – read the  Six mobility offerings from AARP AgeTech Collaborative

Six mobility offerings from AARP AgeTech Collaborative he cell phone – imagine a connected life without it. The story of that invention, particularly the context of an AT&T monopoly of the time period, is instructive about what it takes to get an innovation into the market – when many are involved, including government agencies; and obstacles, in-house and competitors, are all around. According to

he cell phone – imagine a connected life without it. The story of that invention, particularly the context of an AT&T monopoly of the time period, is instructive about what it takes to get an innovation into the market – when many are involved, including government agencies; and obstacles, in-house and competitors, are all around. According to